Easy Monthly Installment (EMI) Calculator – Complete Guide for 2025

Managing finances has become easier than ever, especially with smart tools like EMI calculators. Whether you’re planning to buy a new phone, car, home appliance, or even applying for a personal loan, understanding your monthly installment is essential. This guide will help you learn everything about EMIs, how they are calculated, and why using an EMI calculator saves time, money, and stress.

⭐ What Is an EMI?

EMI (Easy Monthly Installment) is a fixed payment you make every month to repay a loan. It includes two parts:

- Principal Amount – the original money you borrowed

- Interest Amount – the extra amount charged by the bank or company

EMIs stay the same each month, making it easier to manage your budget.

⭐ Why You Need an EMI Calculator

An EMI calculator helps you instantly calculate:

- Your monthly installment

- Total interest you will pay

- Overall cost of the loan

- A clear repayment schedule

Instead of guessing numbers or doing long math, an EMI calculator shows accurate results in just one click.

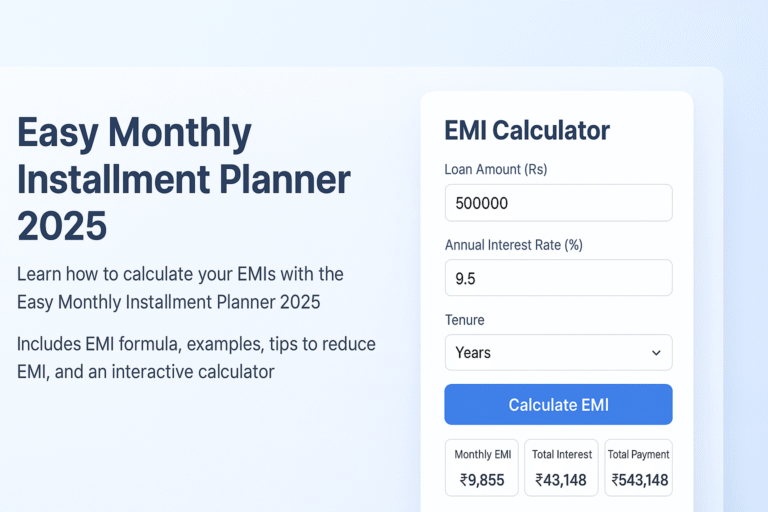

⭐ How an EMI Calculator Works

An EMI calculator uses a standard mathematical formula:

EMI = [P × R × (1+R)ⁿ] / [(1+R)ⁿ – 1]

Where:

- P = Loan Amount

- R = Monthly Interest Rate

- n = Number of Months

The calculator processes all three values and instantly gives you the installment amount.

⭐ Benefits of Using an EMI Calculator

✔ 1. Accurate and Instant

No manual calculations, no errors — results appear instantly.

✔ 2. Helps You Choose the Right Loan

You can compare:

- Different loan amounts

- Different interest rates

- Different time periods

This helps you select the most affordable option.

✔ 3. Financial Planning Becomes Easy

You can see how much of your monthly budget will go to loan payments.

✔ 4. Saves You From Hidden Surprises

By checking the total interest and total cost, you avoid unexpected financial burdens.

⭐ Types of Loans You Can Calculate Using an EMI Calculator

An EMI calculator works for almost every type of loan:

- Personal Loan EMI

- Car Loan EMI

- Motorbike Loan EMI

- Home Loan EMI

- Credit Card Installment EMI

- Mobile Installment Plans (0% interest)

- Student Loan EMI

- Appliance & Electronics Installments

⭐ Example: EMI Calculation for a Loan in 2025

Imagine you borrow PKR 100,000 at 18% annual interest for 12 months.

You enter:

- Loan amount: 100,000

- Interest rate: 18%

- Tenure: 12 months

Your approximate EMI will be around PKR 9,168 per month.

⭐ Why Calcemic EMI Calculator Is Better

The Calcemic EMI Calculator provides:

- Clean and modern design

- Super fast EMI results

- Accurate calculations

- Mobile-friendly interface

- Detailed breakdown (Principal + Interest)

Whether you’re a student, job holder, business owner, or freelancer — this tool makes financial decisions easier.

⭐ Final Thoughts

Before taking any loan or buying anything on installment, always use an EMI calculator. It protects your budget, helps you choose the right plan, and gives you a clear picture of your future payments. The Calcemic EMI Calculator is your perfect companion for smarter financial planning in 2025.

Start calculating your EMI today — and make the right financial move with confidence.